Intel Responds to Trump’s Claim of U.S. Government Securing 10% Stake

GeokHub

On August 22, 2025, President Donald Trump announced that the U.S. government has secured a 10% stake in Intel, valued at approximately $11 billion, following negotiations with CEO Lip-Bu Tan. Intel responded, clarifying the terms of this unprecedented deal, which converts prior government grants into equity. This professional, reader-friendly news article outlines Intel’s response, the deal’s context, implications, and cybersecurity tips for stakeholders, crafted for tech enthusiasts, investors, and policymakers.

Intel’s Official Response

Intel confirmed the U.S. government’s 10% stake, emphasizing it as a passive investment with:

- No Board Representation: The government will not have seats or special governance rights.

- Voting Alignment: The U.S. agrees to vote with Intel’s board on shareholder matters, with limited exceptions.

- Funding Source: The stake converts $11.1 billion in grants, including $2.2 billion received and $8.9 billion pledged under the 2022 CHIPS and Science Act, plus Secure Enclave funds.

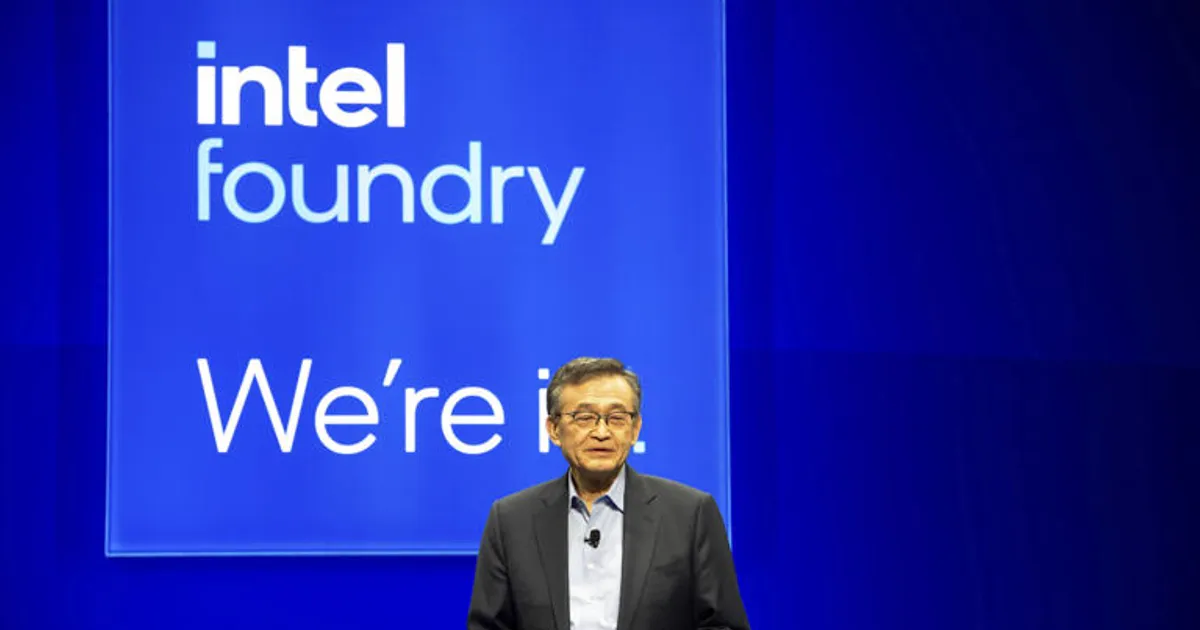

Intel’s statement highlighted its commitment to U.S. semiconductor leadership, with CEO Lip-Bu Tan noting, “This agreement strengthens our role in advancing national priorities.”

Context of the Deal

- Trump’s Claim: Announced via Truth Social, Trump called it a “great deal” for America, claiming no cost to the U.S. as it repurposes Biden-era grants.

- Background: The deal follows Trump’s August 7 call for Tan’s resignation over past China ties, which he reversed after Tan’s White House meeting and loyalty pledge.

- Stock Impact: Intel shares rose 5.5% on August 22, reflecting investor optimism despite the company’s $19 billion loss in 2024 and 20,000 layoffs.

Why It Matters

- Economic Impact: The U.S. becomes one of Intel’s largest shareholders, blurring public-private lines, a move unseen since the 2008 GM bailout ($50 billion for 60% stake).

- Geopolitical Strategy: Supports Trump’s push to boost U.S. chip production, reducing reliance on Asia amid tensions with China.

- Criticism: Some Republicans, like Sen. Rand Paul, call it a “step toward socialism”; Democrats like Sen. Mark Warner urge scrutiny for conflicts of interest.

Cybersecurity Tips for Intel Stakeholders

With 36% of 2024 cyber breaches tied to supply chain attacks and Intel’s role in defense chips, securing systems is critical:

- Enable 2FA: Use two-factor authentication on Intel-related accounts to block 99.9% of hacks.

- Strong Passwords: Create 16-character passwords (e.g., “Int3l2025!Ch1p”) via Bitwarden.

- Antivirus Protection: Install Bitdefender ($50/year) to block 98% of malware targeting tech firms.

- VPN Use: Encrypt connections with NordVPN ($5/month) when accessing Intel investor portals.

- Phishing Awareness: Avoid suspicious links claiming Intel updates; verify via intel.com.

Sample Stakeholder Plan

- Investors: Monitor Intel stock volatility; diversify to mitigate bubble risks.

- Businesses: Secure supply chain data; leverage Intel’s U.S. chip production.

- Weekly: Check Intel’s investor relations for updates; scan emails with Deepware Scanner.

Intel’s confirmation of the U.S. government’s 10% stake, valued at $11 billion, marks a historic public-private partnership aimed at bolstering U.S. chipmaking. While the deal boosts Intel’s stock and aligns with Trump’s tech agenda, it raises concerns about government overreach. Stakeholders should secure systems with 2FA and monitor developments as Intel navigates this shift.